A great inflation report … Luke Lango believes AI stocks will soar … why caution is needed for the longer-term … how Tom Gentile is playing an eventual AI crash

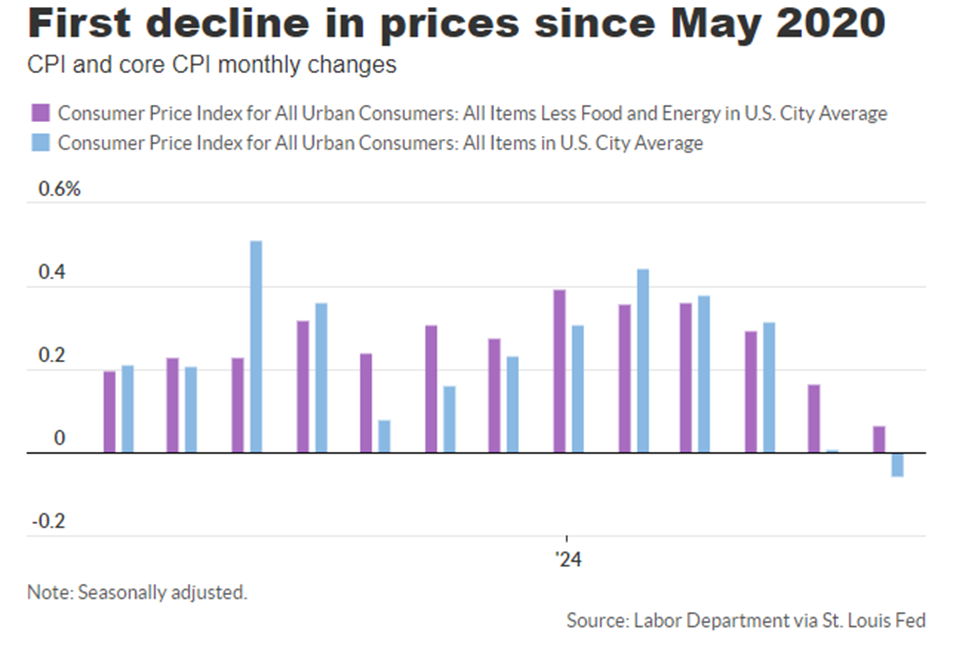

This morning brought great news on the inflation front.

The Consumer Price Index declined 0.1% in June. As you can see below, this was the first decline in prices since May of 2020 (blue line on your right).

Core CPI, which excludes volatile food and energy prices, increased 0.1% monthly and 3.3% year-over year. This was cooler than the respective forecasts of 0.2% and 3.4%.

The good news continues…

Housing costs have been an enormous thorn in the side for the CPI readings for months. But this morning’s data finally brought some relief.

From MarketWatch:

The cost of rent rose just 0.3% in June to mark the smallest increase in almost three years.

The increase in rents in the past 12 months, what’s more, slowed to 5.1% in June from 5.3% in the prior month and touched the lowest level since April 2022.

In the wake of this data, futures traders are ramping up their bets for a September rate hike.

Yesterday, the odds of at least one quarter-point by September were 73.4%. As I write Thursday morning, they’re now at 89.0%.

So, where does this leave stocks?

Well, the answer depends on our chosen timeframe.

For what’s directly in front of us, let’s go to our hypergrowth expert, Luke Lango. From this morning’s Innovation Investor “Buy Alert”:

Here we go!

As widely expected, this morning’s June Consumer Price Index report was very soft, and it all but confirms that the Fed will start to cut interest rates later this summer (in either July or September).

That confirmation essentially gives this AI-obsessed stock market permission to go on a tear over the next few weeks and likely months.

You see – investors are essentially drooling over the AI theme right now. They can’t get enough AI. They want to buy everything AI. And they are looking for any excuse to just keep pushing AI stocks higher and higher and higher.

This is that excuse.

We expect to see AI stocks – which, admittedly, are already red-hot – get even hotter in the coming weeks. We think they’re going to soar.

It is time to go “AI with AI” – or all in with artificial intelligence.

Given this, Luke just recommended three new top-tier AI plays to his Innovation Investor subscribers.

We’re expecting similar buying pressure beneath other interest-rate-sensitive stocks including small caps.

But when we look farther out, our perspective changes

Yes, the coming weeks/months could bring a mad dash toward a huge pile of AI-related stock gains…but what if that pile was placed precariously on the edge of a cliff?

Well, we’d still want the cash, but we’d approach it with greater caution.

Let’s take a few moments to better understand this cliff.

There is a strong inverse relationship between a starting valuation and subsequent stock market returns. What you pay matters – a lot.

It’s basic math that if you pay an expensive price for a stock, your return on investment will be lower than if you paid an inexpensive price.

Let’s walk through some numbers to give you a sense for what this means in real life.

Fundamentally, the two big drivers of stock returns are: 1) dividends, and 2) capital appreciation, which, in the long-term, is heavily driven by earnings growth (also sentiment, which we’ll get to).

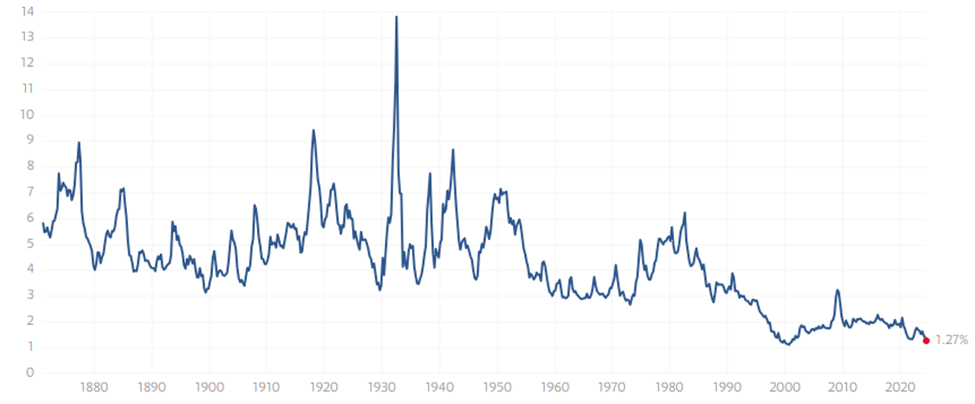

Today, the S&P’s dividend yield is rather pathetic.

As you can see below, with the exception of the Dot-Com crash, it has never been lower in roughly 150 years.

This alone is a big headwind for forward-looking returns.

Investors regularly cite the S&P’s long-term average return of roughly 10%. But what many people don’t realize is that this return doesn’t come purely from price appreciation. It assumes reinvested dividends. In fact, dividends account for about 40% of the S&P’s long-term gains.

So, with the S&P’s current dividend yield at just 1.27% (compared with its average long-term yield of 4.25%), that’s not a good start for forward-looking 10-year returns.

(For today’s analysis, we’ll ignore how corporate managers have increasingly rotated away from dividends toward stock buybacks in recent decades.)

What about capital appreciation from earnings growth?

Two fundamental components of earnings growth are revenue growth and profit-margins.

Over the past three decades, revenue growth has averaged roughly 4% per year. Let’s assume this continues in line.

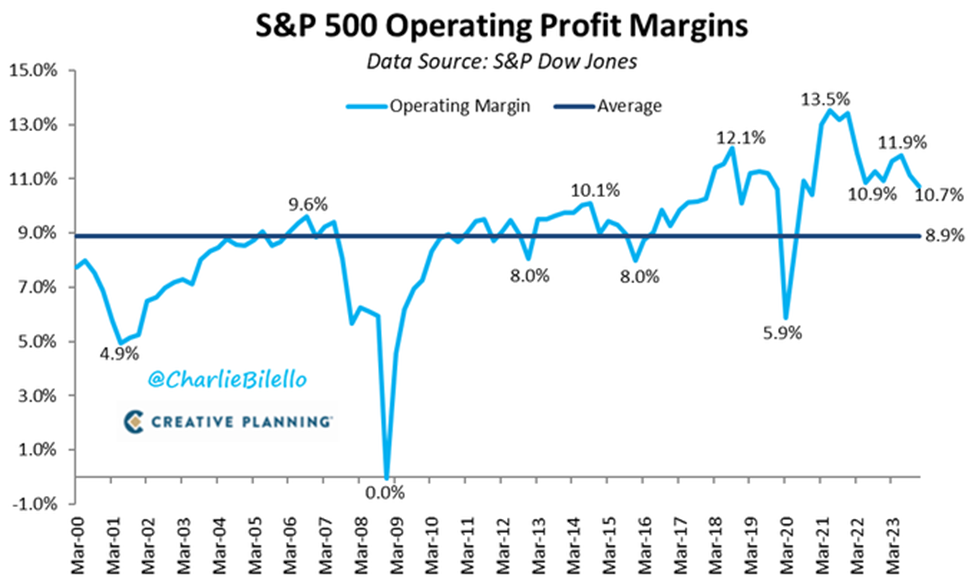

The more volatile component is profit-margins. So, how are things looking there?

Well, we’re coming off one heck of a run with profit-margin expansion. Here’s Stéphane Renevier from Finimize:

Over the past decade, an expansion in profit margins and in the P/E multiple drove most of the exceptional 16.6% annualized returns in the S&P 500.

The challenge is that profit margins ebb and flow. Great expansions are typically followed by great contractions. As the co-founder and chief investment strategist of GMO Jeremy Grantham said, “Profit margins are probably the most mean-reverting series in finance, and if profit margins do not mean-revert, then something has gone badly wrong with capitalism.”

For a visual on this, below, we look at S&P 500’s profit margins since 2000 in a graph from Charlie Bilello. Notice that we’re coming off the highest reading in 23+ years – and headed south.

Now, might we see a bullish reversal that sends profit margins back toward peak levels?

Sure! And we hope that happens.

But if we anchor our analysis in what’s more likely, the odds favor decreasing profit margins from here.

And AI won’t save us. That’s because AI is about to become the price of admission for corporate America. You either utilize it or get left behind.

So, all companies will incorporate appropriate versions of AI in their operations. But this means it will be somewhat commoditized. You and me, as consumers, will benefit. But it won’t result in a profit-margin-bonanza for companies.

That said, let’s be generous and assume that margins don’t decline as is their current trajectory. Instead, let’s say they remain flat.

Well, stable margins with sales growth averaging 4% a year suggests earnings growth of 4% per year. Throw in that 1.27% dividend yield, and we’re looking at average S&P 500 returns of 5.27% per year going forward.

But we’re not quite done…

What about investor sentiment?

As we covered in yesterday’s Digest, stock prices are a function of earnings and the multiple that investors are willing to pay for those earnings (think “investor sentiment,” which we can calculate using the traditional price-to-earnings ratio formula).

The S&P has averaged 18X forward earnings since 1990. We’re higher than that today. If investor sentiment returns to this average over the coming decade, that drags down our just-calculated average return by roughly 2.2% per year.

So, our forecasted S&P 500 return drops to about 3% per year.

Not exactly rip-roaring.

Also, consider the context. The average yearly return over the last 10 years has been 12.6%.

Now, we should consider a few curveballs.

Imagine that the Federal Reserve missteps, and we suffer a mild recession. This means that revenue growth doesn’t come in at its long-term average of 4%, but is flat or negative…

Or let’s not be as generous as before with profit-margins. Say the Fed missteps in the other direction and inflation picks back up despite today’s great CPI report. So, instead of assuming constant profit-margins, they fall…

Or what if investor sentiment doesn’t just return to its average reading, but instead, dips below average?

Well, such underwhelming performance by one (or all) of these three variables could result not in 3% annual returns for the S&P, but 0%.

Please recognize that this isn’t bearishness talking – it’s just math.

But if you’re not a math person, we have one final indicator to take seriously

You’re probably familiar with the old “shoeshine” boy anecdote on Wall Street.

In short, in 1929, a shoeshine boy allegedly offered a stock tip to Joe Kennedy. Kennedy thought to himself, “When even a shoeshine boy is talking stocks, it’s probably time to get out of the market.”

As the story goes, Kennedy exited his long positions, making a killing before “Black Thursday” ushered in the Great Depression.

While we’re not seeing any “shoeshine boy” examples today, there is a similar indicator we can reference…

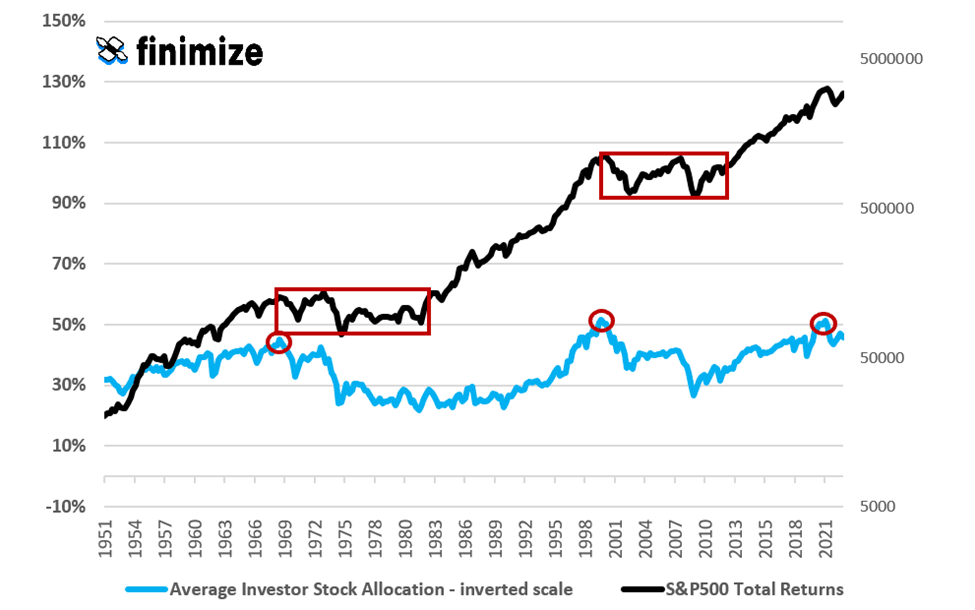

The proportion of assets that investors have allocated to stocks.

When everyone is loaded up on stocks, that’s usually a bad time to be invested as it shows overconfidence.

With this in mind, let’s return to Renevier from Finimize:

A lot of things can influence short-term stock returns: interest rates, economic data, geopolitical stuff, investor sentiment – even weather. But for long-term returns, one factor rules them all: the proportion of assets that investors are parking in stocks.

This ratio has proven to be the most reliable predictor of stock returns over a ten-year horizon, outshining even heavyweight factors like valuations.

It says that when investors go big on stocks, their long-term returns tend to be below average…

Investor over-allocation to stocks has been the most precise warning signal of lost decades. A spike in allocations to stocks (blue line, red shaded circles) preceded both the lost decade of the 1970s and the early 2000s.

While we’re not calling for a lost decade here in the Digest, we’d be foolish to ignore this.

I’ll add that Luke and Tom Gentile are concerned about the coming “cliff” too

Beginning with Luke:

Yes, at some point, this AI rally will run out of fuel. AI stocks will crash, like internet stocks in the early 2000s.

Of course, Luke believes there’s ample time in between now and that crash to profit handsomely from AI plays. This is why he recommended three this morning.

Tom Gentile is of the same opinion.

If Tom is a new name for you, he’s a veteran pattern trader, identifying reliable stock price patterns in historical data, then placing calculated wagers that those patterns will repeat.

From Tom:

Right now, the AI boom is pushing the S&P 500 to its latest all-time highs.

But I believe we’re about to enter the “Final Phase.”

Here’s how it’s going to play out: Over the next few weeks and months, AI stocks are going to continue accelerating. Investors will be lining up to buy shares, pushing prices higher and higher…

Until the whole thing collapses.

This outcome is predetermined. It’s happened countless times over the last 400 years, from Dutch Tulips in the 1600s to the mid-2000s housing market in the U.S.

It’s the classic boom-and-bust cycle. And it’s coming for your AI stocks.

Our Digest is running long today, but to learn exactly what Tom sees coming, watch this free replay of his presentation from Tuesday. He’ll explain why he’s concerned, how he plans to profit from this “Final Phase,” and the steps he’s taking to stop short of running off the cliff.

Wrapping up, even if a cliff is on the way, this morning’s CPI report is likely to juice the market – and we want to benefit

The trend is bullish. And with today’s soft inflation data and Federal Reserve Chairman Jerome Powell signaling rate cuts, we don’t see the trend’s direction changing anytime soon.

Yes, a longer-term assessment of market conditions points toward underwhelming returns, but here and now, the party is likely to get rowdier.

So, as old Wall Street cliché goes, “let’s enjoy the party while the music is playing but remember to dance near the door.”

Have a good evening,

Jeff Remsburg