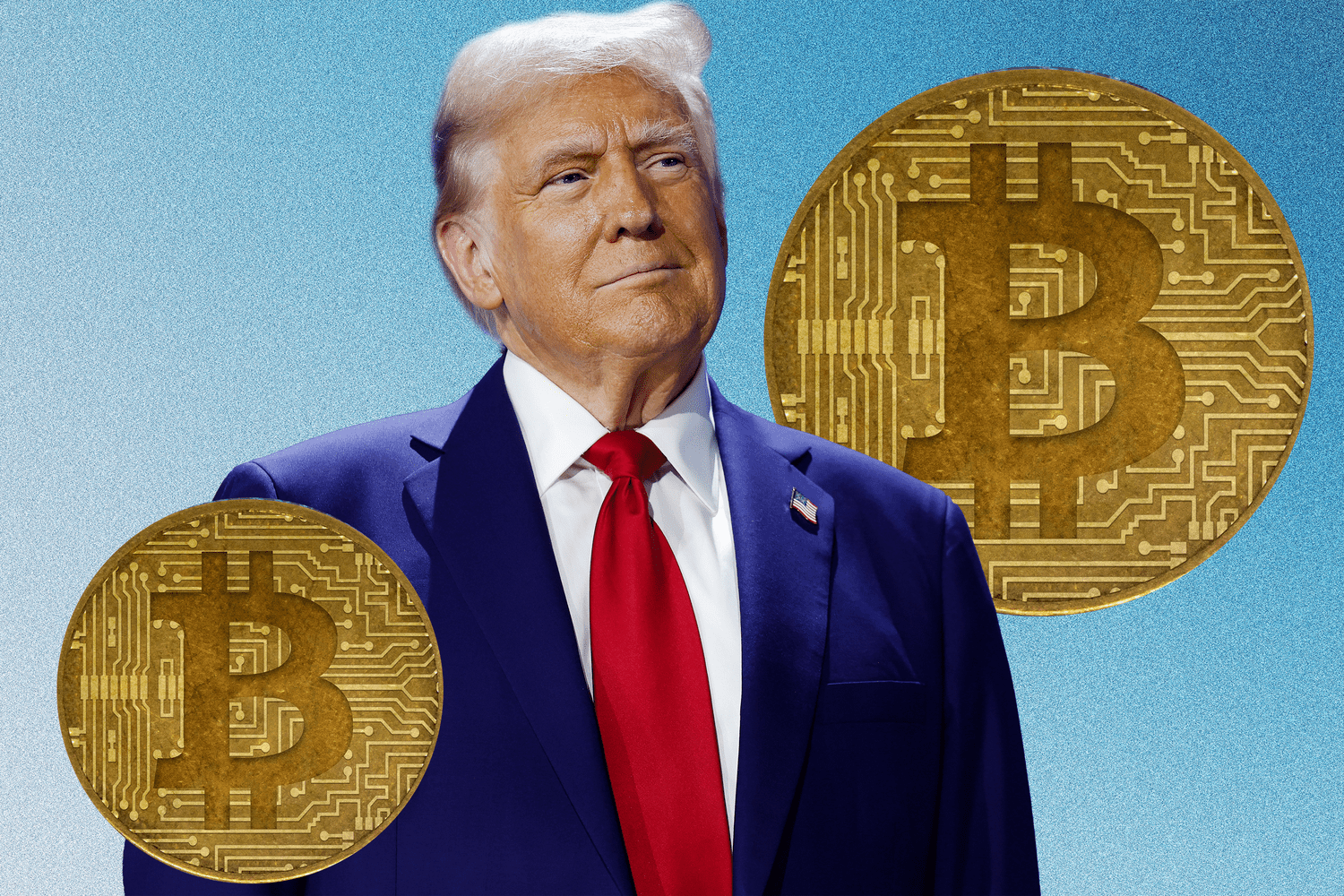

Is the thrill surrounding cryptocurrencies justified by Donald Trump’s re-election victory? For crypto enthusiasts, Trump’s win is more than just political—it feels like vindication. As news of Trump’s re-election broke, bitcoin, the world’s most traded cryptocurrency, saw a 10% spike, peaking at an all-time high of $89,000 on November 11th as Republicans neared control of Congress. Since mid-October, bitcoin has surged by 45%, with the broader crypto market also seeing massive gains. Excluding stablecoins, which are designed to minimize volatility, the top 20 cryptocurrencies have surged even more than bitcoin. Dogecoin, a meme-inspired cryptocurrency often touted by Elon Musk, a Trump supporter, has more than doubled in value since Election Day. On November 12th, the global crypto market value crossed $3 trillion for the first time.

This comeback is remarkable considering the setbacks crypto faced during the 2022-23 downturn. Rising interest rates, mismanagement, and fraud—most notably the collapse of major exchanges like FTX—had shaken the industry. Regulatory authorities were tightening their grip, casting doubt on crypto’s viability. However, with Trump’s re-election, the industry sees a fresh opportunity. Trump has positioned himself as an outspoken advocate for cryptocurrency, promoting projects like World Liberty Financial, a decentralized finance venture backed by his family, and rallying crowds with promises to make America the “bitcoin superpower of the world.” Crypto lobbyists spent over $100 million supporting pro-crypto candidates in Congress, betting on a more favorable regulatory climate under Trump.

Crypto investors have reason to celebrate Trump’s return to office, anticipating a regulatory shift that could ease the industry’s challenges. During a recent industry conference, Trump received enthusiastic applause when he promised to remove Gary Gensler, the current chair of the Securities and Exchange Commission (SEC), who has been a vocal skeptic of crypto. Gensler’s tenure has been marked by regulatory crackdowns and high-profile lawsuits against major crypto firms, pushing these companies to spend heavily on legal fees and compliance measures. Gensler views many digital assets as securities, meaning they fall under SEC regulation. This classification has required crypto firms to disclose more information and meet more stringent requirements than they would prefer, prompting calls for crypto to be regulated as commodities under the more lenient Commodities Futures Trading Commission (CFTC).

A second Trump administration could bring a more lenient and consistent regulatory approach for digital assets. Recent years have seen jurisdictional disputes between the SEC and CFTC over cryptocurrencies like ether. Crypto companies have also accused Gensler of frequently shifting SEC rules for digital assets. Greater regulatory clarity could open doors for large institutional investors, who have thus far been wary of the unstable regulatory landscape.

Still, Trump’s support for cryptocurrencies has not been longstanding; as recently as 2021, he labeled bitcoin a “scam against the dollar.” Whether his administration will deliver the regulatory consistency the industry hopes for remains uncertain. While Trump’s re-election has buoyed crypto markets, the promise of a friendlier regime might still be a gamble.